Global platform close to customers

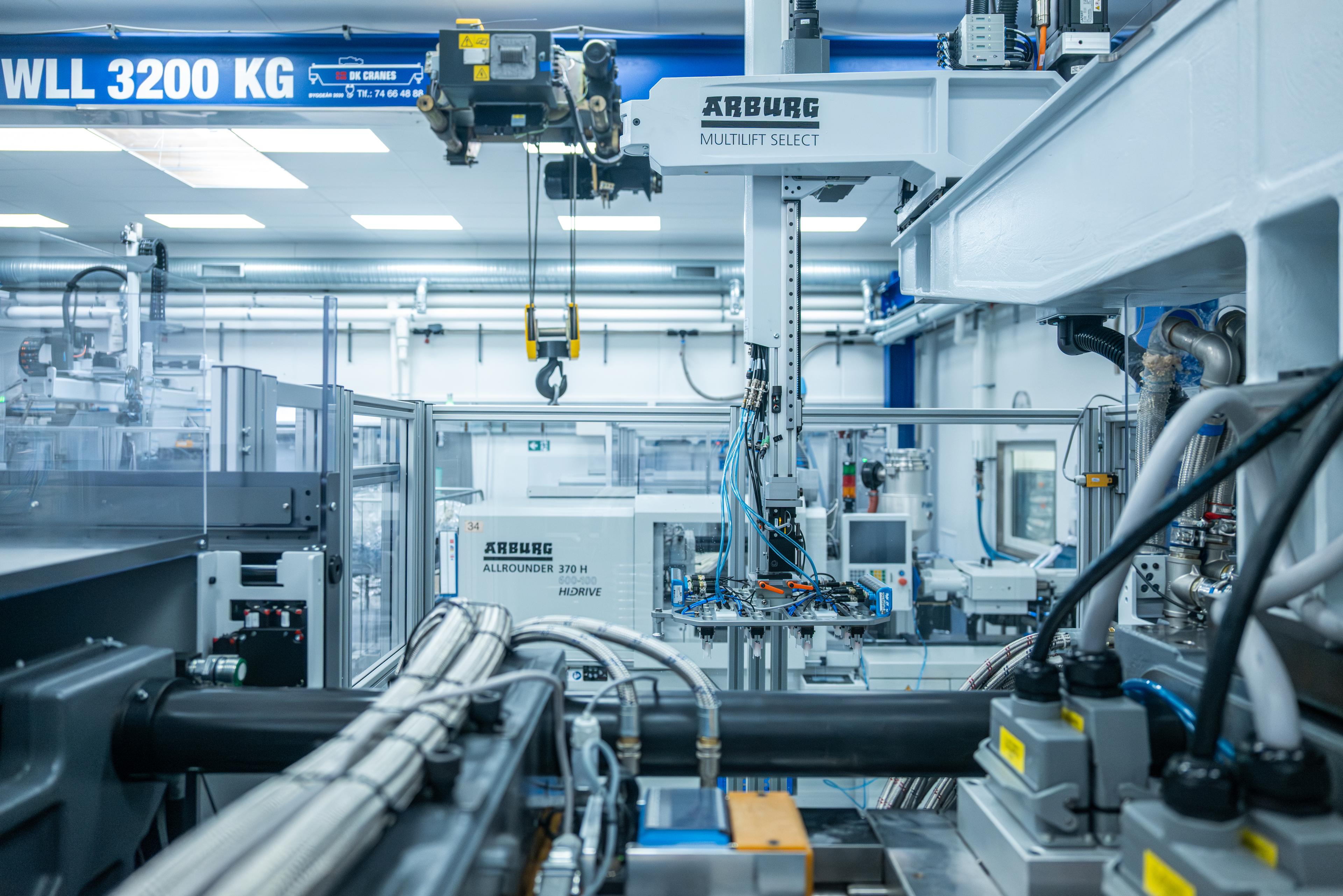

Local-for-local footprint with more than 30 factories typically within 800 km. of customers.

- Short response times, reliable delivery, and lower logistics CO₂.

- Long-term customer relationships anchored in trust and compliance.

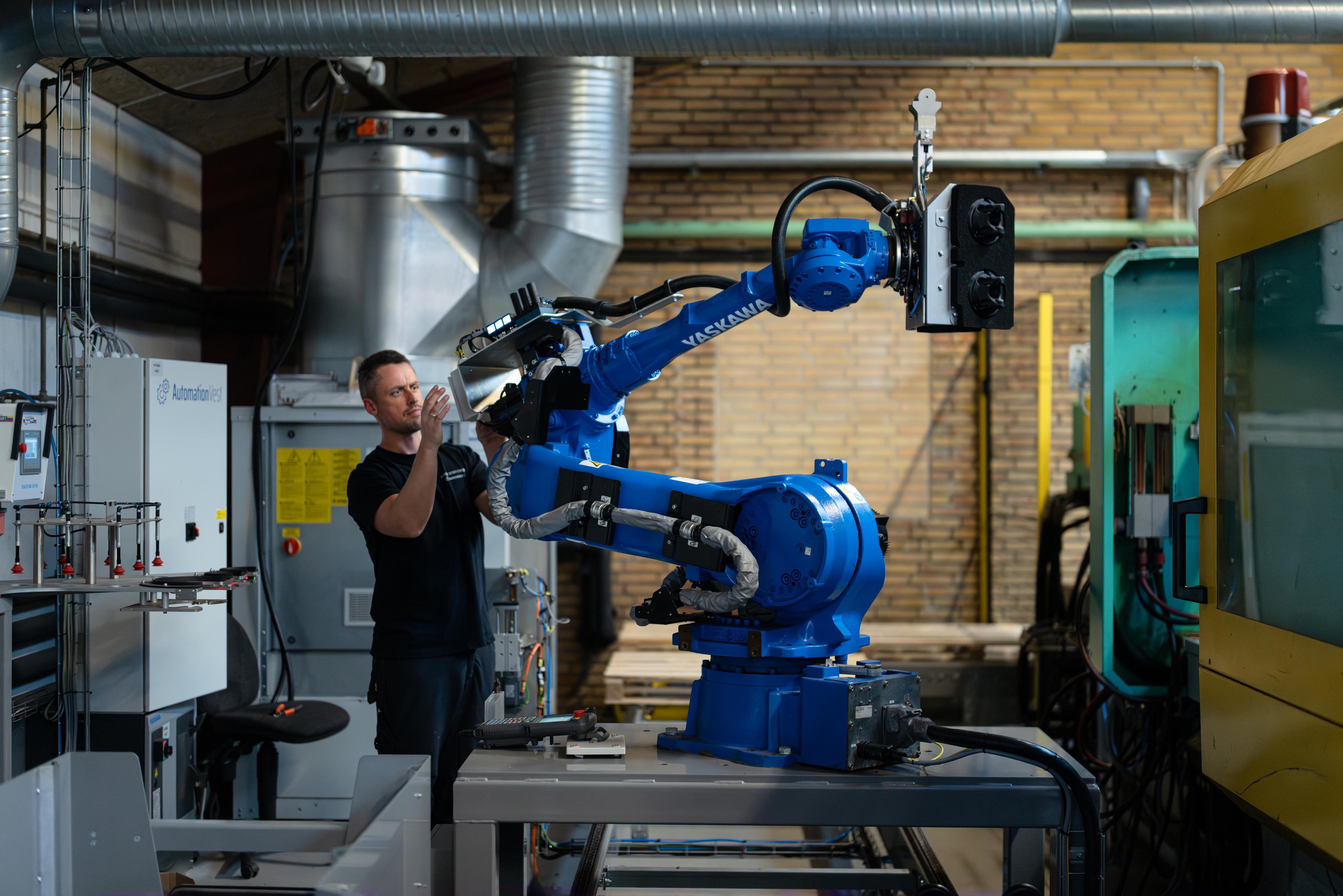

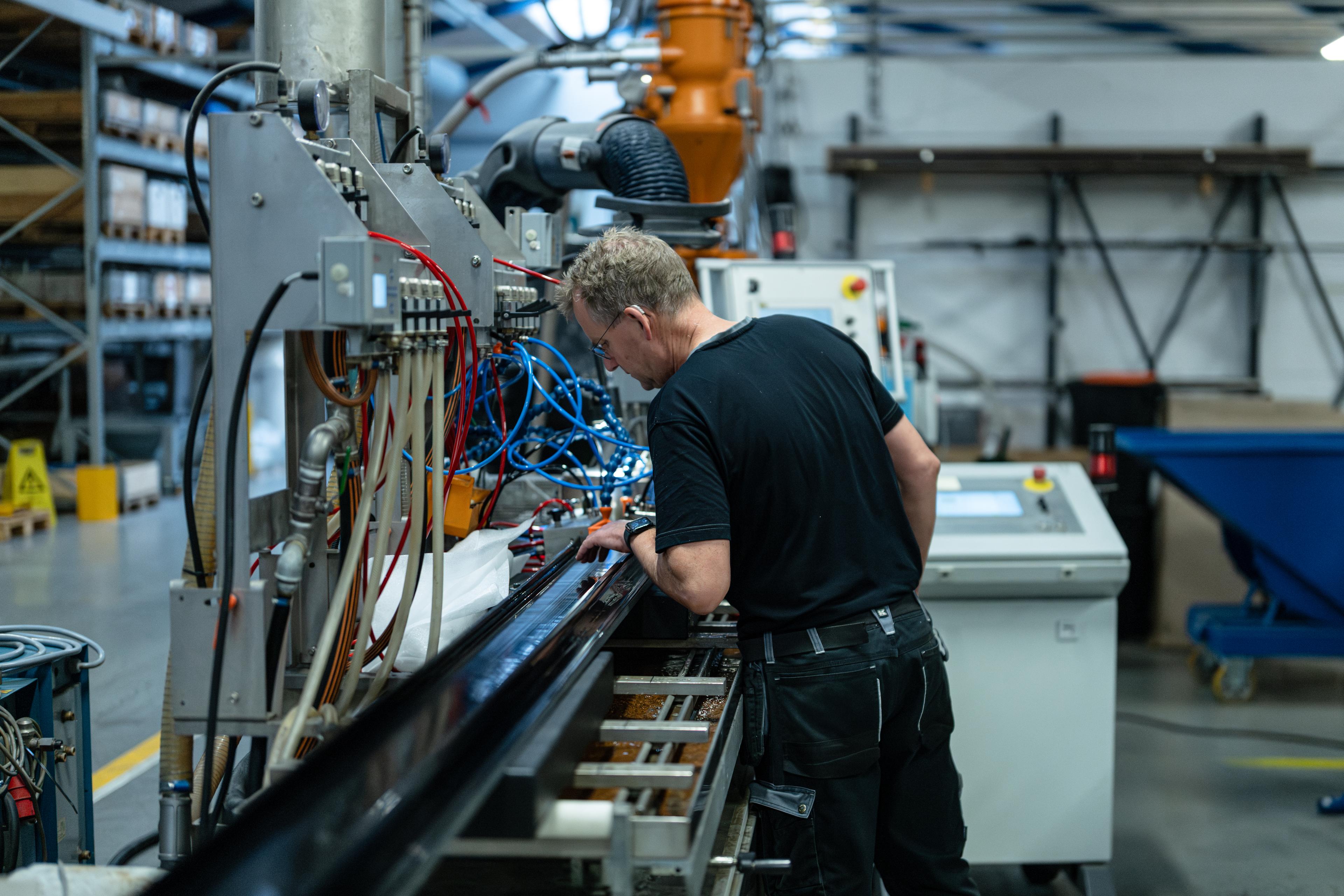

- Advanced polymer and composite solutions for Healthcare, Cleantech, and Foodtech.